While there is a huge range of brokers available, many are lackluster in terms of features, spread, and order execution. However, using the ECN broker can eliminate these issues.

Throughout this guide, we’ll be taking a detailed look at the best ECN brokers, discussing exactly what an ECN broker is, and explaining the benefits of using this type of broker versus a market maker or dealing desk. Let’s get started.

Below, we’ve included a quick description of the top 10 best ECN brokers. Investors looking for detailed reviews can find them in the next section.

- Pepperstone – Overall Best ECN Broker

- Interactive Brokers – Award-Winning Broker

- FXTM – Popular Broker with a Plethora of Educational Resources

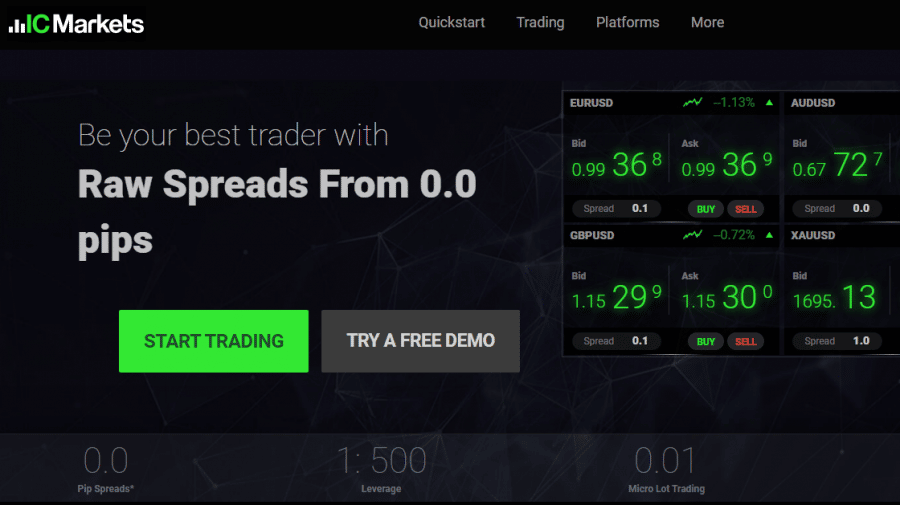

- IC Markets – Low Fee ECN Broker

- Vantage FX – Well-Known Broker with High Leverage

- InstaForex – Trustworthy Broker with Low-Cost Deposits

- HF Markets- Hybrid ECN Broker

- FP Markets – ECN Broker with Huge Range of Assets

- ForexMart – Solid MetaTrader Compatible Platform

- Dukascopy – Trusted Broker with Banking Services

Best ECN Forex Brokers Reviewed

Now that we’ve taken a brief look at the best ECN brokers for forex, it’s time we delve into the details and take an in-depth look at the top contenders.

1. Pepperstone – Overall Best ECN Broker

Founded in 2010, Pepperstone is a global broker providing investors with tight spreads and powerful tools. It boasts over 2000 tradable assets and is regulated by the Finance Conduct Authority (FCA), the Australian Securities and Investment Commission (ASIC), as well as a further three tier 2-3 bodies.

Since its release, Pepperstone has grown exponentially and now provides millions of users around the globe with access to financial products. While Pepperstone is an ECN forex broker, it also offers access to the commodity, ETF, stock, index, and cryptocurrency (not available to UK residents) markets.

The platform supports cTrader and is consistently regarded as being one of the 10 best MT5 brokers. One of the main draws to Pepperstone is its industry-leading market research tools. The broker provides a host of video and written news and analysis, designed to appeal to a broad range of investors. Furthermore, Pepperstone provides its users with access to various tools including pattern recognition and risk management software.

As the best ECN broker, Pepperstone offers its users incredibly tight spreads. While fees can vary based on the instrument traded, they remain some of the lowest in the industry, helping to cement Pepperstone as the best ECN forex broker. For investors looking for a customizable, low-cost platform, with a huge range of tools, it’s difficult to beat Pepperstone.

| Broker | Currency Pairs | Max Leverage | Other Assets | Pricing | Spread (USD/EUR) | Platforms | Accepts US Residents? |

| Pepperstone | 60+ | 500:1 (professional) 200:1 (retail) | Commodities, ETFs, Stocks, Indices, Crypto | Spread-Based + Commission (only on Razor accounts) | 0.17 pips spread$0.04 commission | Web-based, Mobile app, MT4, MT5, cTrader, TradingView | No |

What We Like

- Best Overall ECN Broker

- Integration with leading platforms

- High leverage

- Low fees

- Excellent market research

2. Interactive Brokers – Award-Winning ECN Broker

Founded in 1993, Interactive Brokers is a big name in the forex space. The platform is famous for its lightning-fast order execution, informative market research, and low-cost trading. With Interactive Brokers being rather popular, it’s often mentioned alongside the 11 best low-spread forex brokers.

Out of all the platforms we’ve mentioned, Interactive Brokers offers perhaps the greatest range of tradable assets. Users can trade stocks, options, futures, crypto, bonds, ETFs, and gold. Using the ECN system, interactive brokers aggregates prices from 17 of the largest FX dealers in order to provide its users with the lowest possible cost trades.

Interactive Brokers offers its users the ability to heavily customize the platform to their needs. Every investor with an Interactive Brokers account also has full access to a trove of educational material and market research. Furthermore, with the Interactive Brokers Pro platform, traders have access to over 100 different order types and algorithms.

All in all, there’s a reason why Interactive Brokers is considered to be one of the best ECN brokers on the market. It offers low fair fees, a huge range of instruments, and supports investors from all over the globe. While it doesn’t offer leveraged trading, its margin trading features offset this problem.

| Broker | Currency Pairs | Max Leverage | Other Assets | Pricing | Spread (EUR/USD) | Platforms | Accepts US Residents? |

| Interactive Brokers | 100 | Variable Margin, Typically 25% Maintenance Requirement | Stocks, Options, Futures, Mutual Funds, Commodities, Crypto | Spread + Commission | 0.1 pip + Volume-Based Commission | Two Mobile Apps, investor + Trader Web Platforms | Yes |

What We Like

- Low fees

- Huge range of assets

- Low margin requirements

- Platforms suited to beginners and experienced traders

3. FXTM – Popular Broker with a Plethora of Educational Resources

Launched back in 2011, FXTM or ForexTime has quickly built up a loyal following thanks to its expansive range of features, low fees, and transparency. It’s one of the best CySEC forex brokers on the market and is also regulated by the FCA, highlighting the legitimacy of the platform.

FXTM is one of the top ECN forex brokers and has been attracting a fair amount of attention recently. The platform is intuitive to navigate and presents key information in a clear and concise manner.

Like the fees, different accounts on FXTM are available based on capital. A ‘Micro Account’ supports MT4, boasts a $50 minimum deposit, and offers forex as well as commodity CFDs. Whereas, the Advantage and Advantage Plus Accounts support MT4 + MT5, has a $500 minimum deposit, lower spread fees, commission, and stock/index CFD support.

In addition to boasting a wide range of order types and in-built charting tools, FXTM is one of the best brokers on the market in terms of educational resources. The platform hosts regular webinars/seminars dedicated to forex trading and even provides eBooks and entire guides dedicated to trading strategy. Unlike some ECN forex brokers, FXTM has a clear focus on educating investors.

All in all, while FXTM could be regarded as the best ECN broker for education, it lacks the leverage and number of asset classes offered by Pepperstone.

| Broker | Currency Pairs | Max Leverage | Other Assets | Pricing | Spread (EUR/USD) | Platforms | Accepts US Residents? |

| FXTM | 62 | 1:30 | Commodities, ETFs, Stocks, Indices, Crypto | Spread-Based + Commission | Variable based on funds in account and trading volume | Web-based, Mobile App, MT4, MT5 | No |

What We Like

- Excellent educational material

- Simple to use

- Good range of assets

- Plenty of account types

4. IC Markets – Low Fee ECN Broker

IC Markets is an Australia-based broker, handling more than $15 billion in trades each day. It’s regulated by CySEC, the FSA, and ASIC, so there’s nothing to worry about in terms of safety.

The platform offers some of the lowest fees in the industry. Some spreads are as low as 0.0 pips, although, it’s important to note that for these trades a commission fee of $3.5 will be charged. In addition to its raw spread account, IC Markets also offers a regular trading account as well as an Islamic trading account.

In order to assist beginners making their first foray into the world of trading, IC Markets features a well-designed demo account that uses real-world prices to provide investors with an accurate experience. On top of this, the platform features social trading capabilities, with users able to automatically mirror the trades of more experienced users through ZuluTrade.

With a good range of assets and 1:500 leverage available, IC Markets is one of the best high-leverage brokers right now. While it could benefit from TradingView integration, it’s a well-rounded platform with a lot to offer.

| Broker | Currency Pairs | Max Leverage | Other Assets | Pricing | Spread (EUR/USD) | Platforms | Accepts US Residents? |

| IC Markets | 61 | 1:500 | Commodities, ETFs, Stocks, Indices, Crypto | Spread + Commission | 0.1 pips + $4.50 | MT4, MT5, cTrader, ZuluTrade, Web-Based, Mobile App | No |

What We Like

- ZuluTrade (copy trading)

- High leverage

- Good range of assets

- Supports MT4, MT5, cTrader, and more

5. Vantage FX – Well-Known Broker with High Leverage

Another Australian broker, Vantage FX has grown to become rather popular thanks to its low fees, easy deposit/withdrawals, and simple account creation process. The broker is regulated by the FCA and ASIC, meaning that the platform is safe and making Vantage FX is one of the best forex ECN brokers available.

While Vantage FX does offer a reasonable range of currency pairs (40) it lacks the variety of assets offered by brokers like Peppertrade. However, Vantage’s various platforms help to make up for that. The broker allows investors to copy trade, integrate with MetaTrader, and trade on the go. For investors that like customizability, this could make vantage quite an attractive option.

In addition to its raw and professional ECN accounts, Vantage FX also offers a regular STP account and a demo account with unlimited funds. The platform comes bundled with a number of useful tools to help investors calculate things like profit and fees. Furthermore, less-experienced investors can take advantage of Vantage FX’s impressive range of reading material.

Although Vantage FX might not be quite as asset diverse as some other brokers, its huge range of platforms and tiny fees (even by the best ECN broker standards) helps to ensure that Vantage FX is a rock solid platform and one of the better forex ECN brokers.

| Broker | Currency Pairs | Max Leverage | Other Assets | Pricing | Spread (EUR/USD) | Platforms | Accepts US Residents? |

| Vantage FX | 40 | 1:500 | Stocks, Commodities, Crypto | Spread + Commission | 0.1 pips + $3 | Mobile app, Web Trader, MT4, MT5, ZuluTrade, Vantage Copy Trading | No |

What We Like

- Extremely low fees

- Huge range of platforms

- 1:500 leverage

- Transparent fee structure

Best ECN Forex Brokers Compared

Below, we’ve included a simple-to-understand table detailing key points of the top 10 best ECN brokers for forex.

| Broker | Currency Pairs | Max Leverage | Other Assets | Pricing | Spread (USD/EUR) | Platforms | Accepts US Residents? |

| Pepperstone | 60+ | 1:500 (professional) 1:200 (retail) | Commodities, ETFs, Stocks, Indices, Crypto | Spread-Based + Commission (only on Razor accounts) | 0.17 pips spread$0.04 commission | Web-based, Mobile app, MT4, MT5, cTrader, TradingView | No |

| Interactive Brokers | 100 | Variable Margin, Typically 25% Maintenance Requirement | Stocks, Options, Futures, Mutual Funds, Commodities, Crypto | Spread + Commission | 0.1 pip + Volume-Based Commission | Two Mobile Apps, investor + Trader Web Platforms | Yes |

| FXTM | 62 | 1:30 | Commodities, ETFs, Stocks, Indices, Crypto | Spread + Commission | Variable based on funds in account and trading volume | Web-based, Mobile App, MT4, MT5 | No |

| IC Markets | 61 | 1:500 | Commodities, ETFs, Stocks, Indices, Crypto | Spread + Commission | 0.1 pips + $4.50 | MT4, MT5, cTrader, ZuluTrade, Web-Based, Mobile App | No |

| Vantage FX | 40 | 1:500 | Stocks, Commodities, Crypto | Spread + Commission | 0.1 pips + $3 | Mobile app, Web Trader, MT4, MT5, ZuluTrade, Vantage Copy Trading | No |

| InstaForex | 120 | 1:1000 | CFDs, Indices, Futures, Crypto | Spread + Commission | 3 pips + 0.03-0.07% | MT4, MT5, Multiterminal, WebTrader, FastTrader, Mobile App | No |

| HF Markets | 50 | 1:30 | Commodities, ETFs, , Indices, Bonds | Spread + Commission | 0.1 pips+ lot size-based commission | MT4, MT5, Web-based, Mobile App | No |

| FP Markets | 60 | 1:500 | Stocks, Bonds, Indices, Commodities, Crypto | Spread + Commission | Variable (around 0.1 pip) + $3 | MT4, MT5, Web-based, Mobile App | No |

| ForexMart | 61 | 1:500 | Stocks, Commodities, Crypto | Spread + Commission | 0.1 pips + $6 | Web-based, MT4, Mobile | No |

| Dukascopy | 23 | 1:200 | Stocks, Commodities, Crypto, Bonds, Indices | Spread + Commission | 0.2 pips + $0.5 | Web-based, MT4, Mobile, JForex | No |

What is an ECN Broker?

It can be difficult to work out the differences between broker types but it’s crucial for anyone serious about trading.

An ECN or electronic communication network broker essentially acts as an aggregator for other market makers. When somebody places a trade with an ECN broker, the platform will automatically search for the best possible deal on the market and execute the order with that provider.

While this allows investors to get the best possible price, it isn’t without a downside. While many brokers will offer commission-free trading at the expense of spread fees, an ECN broker will offer the lowest spread but will tack on a commission fee. As such, it’s important to consider things like expected volume and lot size before partnering with a specific exchange.

Another common type of broker is a market maker. These platforms will typically fulfill trades themselves while taking an opposite position to the user. While a market maker will generally offer higher spreads, they tend not to charge commission.

So while an ECN broker simply matches a trade between other platforms, a market maker will fulfill the order themselves and take an opposite position in order to manage risk.

Benefits of Using an ECN Broker

When it comes to deciding which type of broker is best suited to a particular investor, it’s important to look at what benefits are offered. In order to make this as simple as possible, we’ve outlined a few of the most prominent benefits to the best ECN broker.

Transparency

One of the biggest advantages of trading with an ECN broker is transparency. As these brokers use a network, every platform has access to exactly the same information at the exact same time. This means that any ECN broker should offer precisely the same prices for an asset at a given time (although spread and commission can still vary).

Fairness

As everyone has access to the same information and price history, it’s easier to analyze market trends. In theory, this helps to reduce market manipulation and puts traders on even ground.

Price

Perhaps the most important benefit to trading with an ECN broker is getting the best possible price. When using an ECN-based platform, a trade should always execute at the best price on the market. Considering forex trading often involves taking advantage of small price movements using high leverage, this can end up making a big difference.

Conclusion

Throughout this guide, we’ve reviewed the best ECN broker on the market and taken a look at what an ECN broker is and how they work. However, while each of the platforms we’ve reviewed is packed full of features and provides a lot of key trading tools, there was one particular platform that stood out from the crowd.